Choosing between a pay-as-you-go and a prepaid toll account depends on your travel patterns and budget preferences. Pay-as-you-go accounts allow flexibility by charging only for tolls incurred, making them ideal for occasional travelers without upfront fees. Prepaid toll accounts require an initial deposit but offer convenience and sometimes discounted rates for frequent commuters.

Table of Comparison

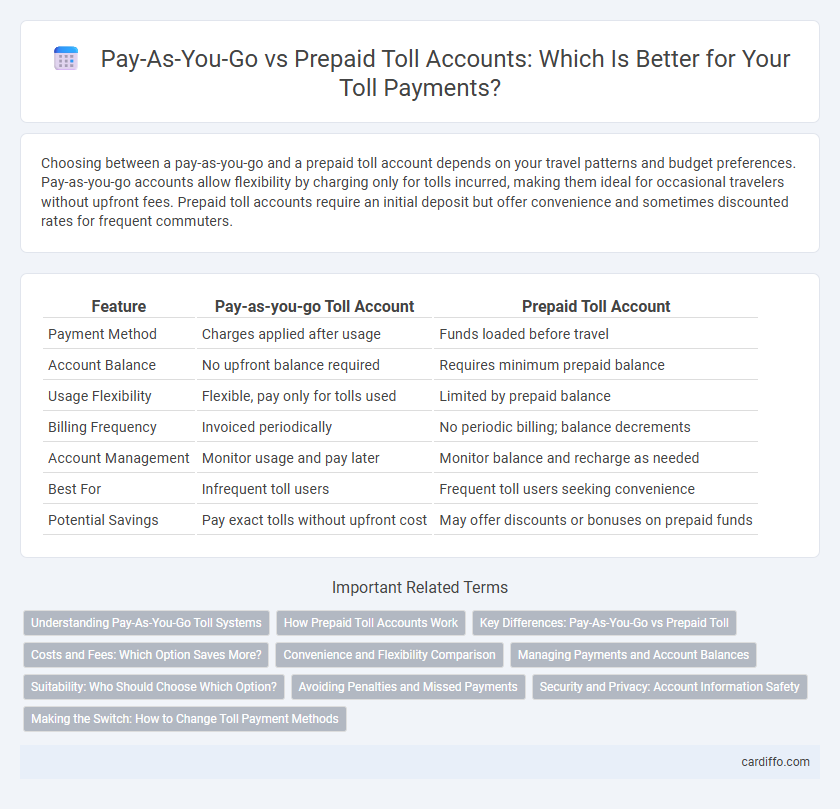

| Feature | Pay-as-you-go Toll Account | Prepaid Toll Account |

|---|---|---|

| Payment Method | Charges applied after usage | Funds loaded before travel |

| Account Balance | No upfront balance required | Requires minimum prepaid balance |

| Usage Flexibility | Flexible, pay only for tolls used | Limited by prepaid balance |

| Billing Frequency | Invoiced periodically | No periodic billing; balance decrements |

| Account Management | Monitor usage and pay later | Monitor balance and recharge as needed |

| Best For | Infrequent toll users | Frequent toll users seeking convenience |

| Potential Savings | Pay exact tolls without upfront cost | May offer discounts or bonuses on prepaid funds |

Understanding Pay-As-You-Go Toll Systems

Pay-as-you-go toll systems charge drivers based on actual road usage, deducting fees automatically from linked payment methods like credit cards or bank accounts, offering flexibility without upfront deposits. These systems rely on electronic toll collection technologies such as RFID transponders or license plate recognition to facilitate seamless passage and real-time billing. Understanding pay-as-you-go toll mechanisms helps optimize travel costs by avoiding overpayments and ensuring accurate, usage-based charges.

How Prepaid Toll Accounts Work

Prepaid toll accounts require users to deposit funds in advance, allowing automatic deduction of toll fees when using toll roads. These accounts help drivers avoid fines and delays by ensuring sufficient balance for every toll transaction. Maintaining a prepaid balance offers convenience and seamless travel without the need for cash or credit card payments at toll plazas.

Key Differences: Pay-As-You-Go vs Prepaid Toll

Pay-as-you-go toll accounts charge users based on actual road usage, with fees deducted after travel, providing flexibility without upfront costs. Prepaid toll accounts require depositing funds in advance, ensuring seamless passage but needing balance management to avoid service interruption. Key differences include payment timing, account balance requirements, and convenience in toll cost tracking.

Costs and Fees: Which Option Saves More?

Pay-as-you-go toll accounts charge fees only when you use the toll road, often resulting in higher per-trip costs due to transaction fees and variable toll rates. Prepaid toll accounts typically offer discounted toll rates and eliminate transaction fees, making them more cost-effective for frequent travelers. Choosing a prepaid account can lead to significant savings over time by reducing fees and locking in lower toll prices.

Convenience and Flexibility Comparison

Pay-as-you-go toll accounts offer unmatched flexibility by allowing users to pay only for the tolls they incur without an upfront deposit, making them ideal for occasional travelers. Prepaid toll accounts provide convenience through automatic balance replenishment and discounted toll rates, ensuring seamless travel without the worry of insufficient funds. Both options cater to different needs, with pay-as-you-go favoring cost control and prepaid accounts enhancing ease of use.

Managing Payments and Account Balances

Pay-as-you-go toll accounts allow users to manage payments by directly debiting funds based on actual toll usage, ensuring real-time balance updates without the need for upfront deposits. Prepaid toll accounts require users to add funds in advance, creating a positive account balance that diminishes with each toll transaction and necessitating periodic top-ups to maintain sufficient funds. Efficient management of these accounts involves monitoring transaction history, setting balance alerts, and choosing between immediate usage charges or preloaded credit to optimize toll expenses.

Suitability: Who Should Choose Which Option?

Pay-as-you-go toll accounts suit occasional drivers who prefer flexibility without upfront deposits, ideal for those with irregular travel patterns or short-term trips. Prepaid toll accounts benefit frequent commuters seeking budget control and convenience, as they allow users to load funds in advance and often include discounted toll rates. Businesses with multiple vehicles might opt for prepaid plans to streamline expense management and monitor usage efficiently.

Avoiding Penalties and Missed Payments

Pay-as-you-go toll accounts reduce the risk of penalties by charging tolls only when they occur, ensuring users pay precisely for their usage without upfront commitment. Prepaid toll accounts require maintaining a positive balance to avoid service interruptions and potential fines, demanding regular monitoring and replenishment. Effective management of either account type minimizes missed payments and associated penalties, providing a smoother toll payment experience.

Security and Privacy: Account Information Safety

Pay-as-you-go toll accounts enhance security by charging only the amount used, minimizing stored funds and reducing risk exposure in case of data breaches. Prepaid toll accounts require upfront deposits, which can increase the potential loss if account information is compromised. Both systems use encryption and secure authentication, but pay-as-you-go models often limit stored personal data, offering a stronger safeguard for user privacy.

Making the Switch: How to Change Toll Payment Methods

Switching from a prepaid toll account to pay-as-you-go involves updating your payment settings through your toll service provider's online portal or mobile app. Ensure your vehicle's license plate and payment information are accurately entered to avoid violations and fines. Confirm the change with customer support to verify your account is active and set to the new payment method before using toll roads.

Pay-as-you-go vs Prepaid toll account Infographic

cardiffo.com

cardiffo.com