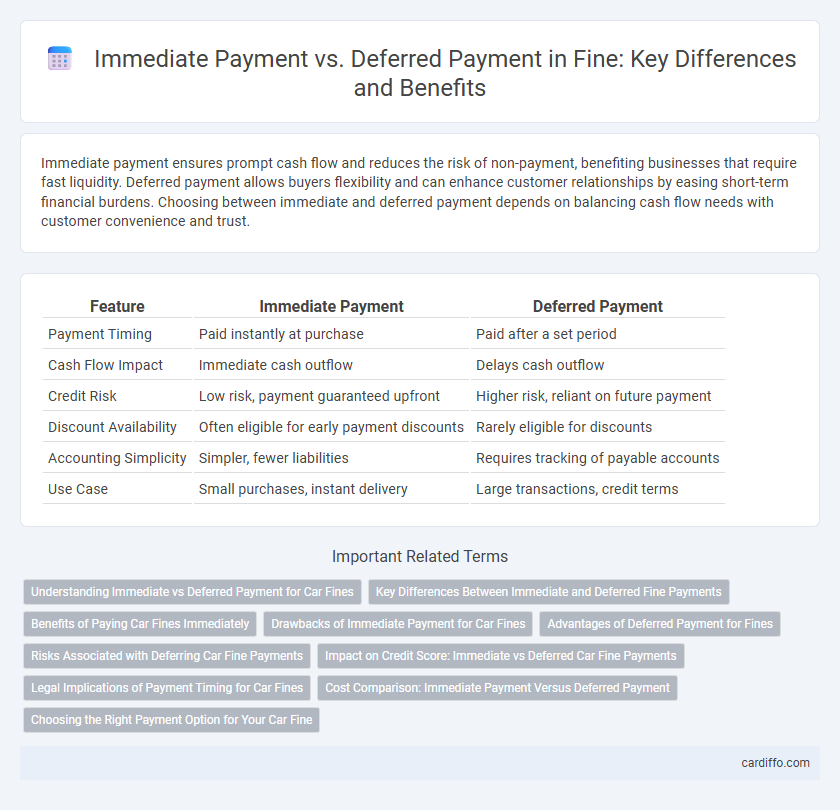

Immediate payment ensures prompt cash flow and reduces the risk of non-payment, benefiting businesses that require fast liquidity. Deferred payment allows buyers flexibility and can enhance customer relationships by easing short-term financial burdens. Choosing between immediate and deferred payment depends on balancing cash flow needs with customer convenience and trust.

Table of Comparison

| Feature | Immediate Payment | Deferred Payment |

|---|---|---|

| Payment Timing | Paid instantly at purchase | Paid after a set period |

| Cash Flow Impact | Immediate cash outflow | Delays cash outflow |

| Credit Risk | Low risk, payment guaranteed upfront | Higher risk, reliant on future payment |

| Discount Availability | Often eligible for early payment discounts | Rarely eligible for discounts |

| Accounting Simplicity | Simpler, fewer liabilities | Requires tracking of payable accounts |

| Use Case | Small purchases, instant delivery | Large transactions, credit terms |

Understanding Immediate vs Deferred Payment for Car Fines

Immediate payment of car fines requires settling the full amount at the time of the violation, often accompanied by discounts or reduced penalties. Deferred payment allows vehicle owners to pay the fine at a later date but may involve additional fees, higher interest rates, or increased penalties. Understanding the terms, deadlines, and potential cost differences between immediate and deferred payment options helps drivers manage car fine obligations effectively while minimizing financial impact.

Key Differences Between Immediate and Deferred Fine Payments

Immediate fine payments require the full amount to be settled at the time of issuance, ensuring prompt resolution and avoiding additional penalties. Deferred fine payments allow individuals to pay the fine at a later date, often with possible installment options but may include interest or late fees. Key differences include timing of payment, potential financial impact, and administrative processing requirements.

Benefits of Paying Car Fines Immediately

Paying car fines immediately helps avoid additional late fees and penalties that can significantly increase the total amount owed. Immediate payment ensures your driving record remains clean, preventing potential license suspension or increased insurance premiums. Prompt settlements also reduce stress and administrative hassle by closing the case quickly and allowing you to move forward without ongoing legal concerns.

Drawbacks of Immediate Payment for Car Fines

Immediate payment for car fines can strain an individual's cash flow, especially if the amount is substantial, limiting financial flexibility. This approach may also lead to missed opportunities for negotiating reduced fines or payment plans that alleviate financial burden. Moreover, immediate payments often eliminate the possibility of contesting the fine, potentially resulting in unjust penalties.

Advantages of Deferred Payment for Fines

Deferred payment for fines offers significant financial flexibility by allowing individuals to manage cash flow more effectively without immediate economic strain. This option can prevent default or penalties associated with late payments, preserving credit standing and reducing stress. Moreover, deferred payments often come with structured plans that simplify budgeting and ensure timely resolution of outstanding fines.

Risks Associated with Deferring Car Fine Payments

Deferring car fine payments increases the risk of accumulating additional penalties and interest charges, significantly raising the total amount owed. Late payments can lead to suspended licenses, vehicle registration holds, or even legal actions such as court summons or wage garnishments. Ignoring prompt payment also negatively impacts credit scores and complicates future financial transactions.

Impact on Credit Score: Immediate vs Deferred Car Fine Payments

Paying a car fine immediately can positively impact your credit score by avoiding late payment marks and potential collections, which are often reported to credit bureaus. Deferred payment may lead to increased risk of missed deadlines, resulting in penalties and negative entries that significantly lower creditworthiness. Timely settlements demonstrate financial responsibility, helping maintain or improve credit ratings over time.

Legal Implications of Payment Timing for Car Fines

Immediate payment of car fines often results in reduced penalties and fewer legal complications, as prompt settlement can prevent escalation into additional fees or court proceedings. Deferred payment may require formal agreements or installment plans authorized by the court, potentially involving interest charges and stricter enforcement measures if payments are missed. Understanding local traffic laws and regulations is crucial, as non-compliance with payment deadlines can lead to license suspension, vehicle impoundment, or increased fines under legal statutes.

Cost Comparison: Immediate Payment Versus Deferred Payment

Immediate payment often incurs a higher upfront cost but can lead to significant savings by avoiding interest charges or financing fees associated with deferred payment plans. Deferred payment typically spreads the cost over time, potentially increasing the total amount paid due to added interest or administrative fees. Evaluating the total cost of ownership, including possible discounts for immediate payment and interest rates on deferred options, is essential for cost-effective financial decisions.

Choosing the Right Payment Option for Your Car Fine

Choosing the right payment option for your car fine depends on your financial situation and urgency to resolve the penalty. Immediate payment often comes with a discount or avoids additional fees, making it cost-effective for those who can afford it upfront. Deferred payment allows more flexibility but may include interest or late fees, so evaluate the total cost before deciding.

Immediate payment vs deferred payment Infographic

cardiffo.com

cardiffo.com