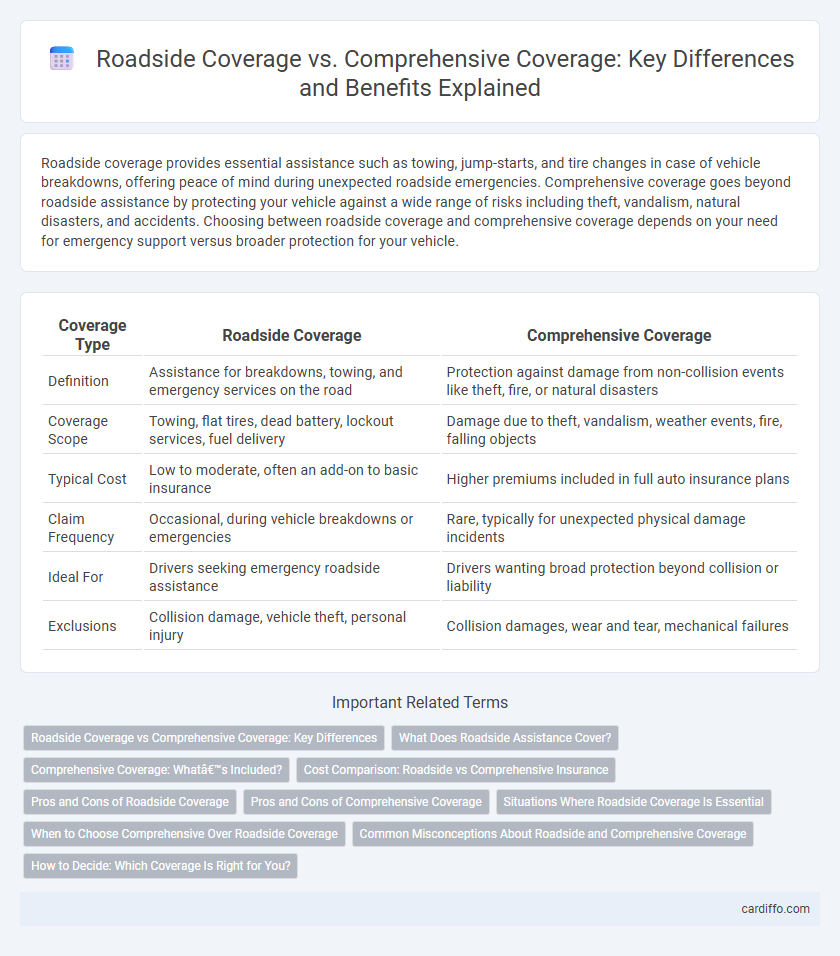

Roadside coverage provides essential assistance such as towing, jump-starts, and tire changes in case of vehicle breakdowns, offering peace of mind during unexpected roadside emergencies. Comprehensive coverage goes beyond roadside assistance by protecting your vehicle against a wide range of risks including theft, vandalism, natural disasters, and accidents. Choosing between roadside coverage and comprehensive coverage depends on your need for emergency support versus broader protection for your vehicle.

Table of Comparison

| Coverage Type | Roadside Coverage | Comprehensive Coverage |

|---|---|---|

| Definition | Assistance for breakdowns, towing, and emergency services on the road | Protection against damage from non-collision events like theft, fire, or natural disasters |

| Coverage Scope | Towing, flat tires, dead battery, lockout services, fuel delivery | Damage due to theft, vandalism, weather events, fire, falling objects |

| Typical Cost | Low to moderate, often an add-on to basic insurance | Higher premiums included in full auto insurance plans |

| Claim Frequency | Occasional, during vehicle breakdowns or emergencies | Rare, typically for unexpected physical damage incidents |

| Ideal For | Drivers seeking emergency roadside assistance | Drivers wanting broad protection beyond collision or liability |

| Exclusions | Collision damage, vehicle theft, personal injury | Collision damages, wear and tear, mechanical failures |

Roadside Coverage vs Comprehensive Coverage: Key Differences

Roadside coverage provides essential services such as towing, battery jump-starts, and flat tire changes when a vehicle breaks down, while comprehensive coverage protects against a broader range of risks including theft, vandalism, weather damage, and collision. Roadside coverage typically supplements existing auto insurance, offering immediate assistance during emergencies, whereas comprehensive coverage is a standalone policy component covering financial losses from various perils. Understanding the scope and limitations of each coverage helps drivers choose the right protection based on their needs and risk exposure.

What Does Roadside Assistance Cover?

Roadside assistance coverage typically includes services such as towing, battery jump-starts, flat tire changes, fuel delivery, and lockout assistance, designed to help drivers during unexpected vehicle breakdowns. Unlike comprehensive coverage, which protects against a wide range of damages including theft, vandalism, and natural disasters, roadside assistance focuses strictly on immediate vehicle disablement scenarios. This coverage is essential for drivers seeking peace of mind during travel, ensuring help is available in case of mechanical issues or minor emergencies on the road.

Comprehensive Coverage: What’s Included?

Comprehensive coverage protects against non-collision-related incidents such as theft, vandalism, natural disasters, and animal damage, providing extensive financial security beyond basic roadside assistance. It typically covers repairs or replacement costs for windshield damage, fire, flood, hail, and falling objects, ensuring broader protection for your vehicle. Unlike roadside coverage, which mainly assists with roadside emergencies, comprehensive coverage offers all-encompassing protection against various unpredictable risks.

Cost Comparison: Roadside vs Comprehensive Insurance

Roadside coverage typically costs significantly less than comprehensive insurance, as it only protects against vehicle breakdowns and emergencies such as towing or battery jumps. Comprehensive coverage, which includes protection against theft, vandalism, natural disasters, and accidents, usually involves higher premiums due to its broader scope. For drivers seeking essential assistance without full vehicle protection, roadside insurance offers a cost-effective solution compared to more expensive comprehensive policies.

Pros and Cons of Roadside Coverage

Roadside coverage offers essential benefits such as towing, battery jump-starts, and lockout assistance, making it a cost-effective option for unexpected vehicle breakdowns. However, it does not cover vehicle damage, theft, or collision expenses, which comprehensive coverage includes. Choosing roadside coverage can be advantageous for drivers with reliable vehicles who want to avoid higher premiums but risky if extensive protection is needed.

Pros and Cons of Comprehensive Coverage

Comprehensive coverage protects against non-collision incidents such as theft, vandalism, natural disasters, and falling objects, offering broader protection than roadside assistance, which primarily handles vehicle breakdowns and emergencies. This insurance type often comes with higher premiums but reduces out-of-pocket expenses by covering costly repairs or replacement for damages unrelated to accidents. While comprehensive coverage is ideal for protecting valuable or newer vehicles, it may not be cost-effective for older cars with low market value.

Situations Where Roadside Coverage Is Essential

Roadside coverage is essential during unexpected vehicle breakdowns such as flat tires, dead batteries, or being locked out, providing quick assistance to avoid being stranded. Unlike comprehensive coverage that protects against theft, vandalism, or natural disasters, roadside coverage specifically offers immediate help for on-the-spot mechanical issues. Having roadside coverage ensures access to towing, jump starts, fuel delivery, and lockout services, which are critical in emergency roadside situations.

When to Choose Comprehensive Over Roadside Coverage

Choose comprehensive coverage over roadside coverage when seeking protection against a wide range of non-collision risks such as theft, vandalism, weather damage, and animal collisions. Comprehensive insurance provides broader financial security beyond just emergency roadside assistance, covering repair or replacement costs for your vehicle. Opt for comprehensive coverage if you want to minimize out-of-pocket expenses related to damages not involving an accident or breakdown.

Common Misconceptions About Roadside and Comprehensive Coverage

Common misconceptions about roadside coverage and comprehensive coverage often confuse their distinct purposes; roadside coverage primarily assists with vehicle breakdowns, flat tires, and towing, while comprehensive coverage protects against non-collision damage such as theft, vandalism, and natural disasters. Many drivers mistakenly believe roadside coverage replaces comprehensive insurance, but it only supplements it by providing emergency services. Understanding these differences is crucial for selecting adequate auto insurance tailored to specific risk needs.

How to Decide: Which Coverage Is Right for You?

Roadside coverage provides essential services such as towing, battery jump-starts, and lockout assistance, ideal for drivers seeking peace of mind during breakdowns. Comprehensive coverage protects against a broad range of non-collision incidents like theft, vandalism, and weather damage, making it suitable for those who want extensive vehicle protection. Evaluate your driving habits, vehicle age, and risk tolerance to determine whether roadside assistance or comprehensive coverage aligns best with your insurance needs.

Roadside coverage vs comprehensive coverage Infographic

cardiffo.com

cardiffo.com