Limited coverage for roadside pet services typically includes basic assistance such as emergency feeding or simple transportation, while comprehensive coverage offers extensive support like veterinary visits, pet grooming, and extended transportation services. Choosing comprehensive coverage ensures pets receive thorough care and protection in emergencies, reducing stress for owners. Limited plans may be suitable for occasional needs, but comprehensive options provide peace of mind and greater value for frequent travelers or pet owners.

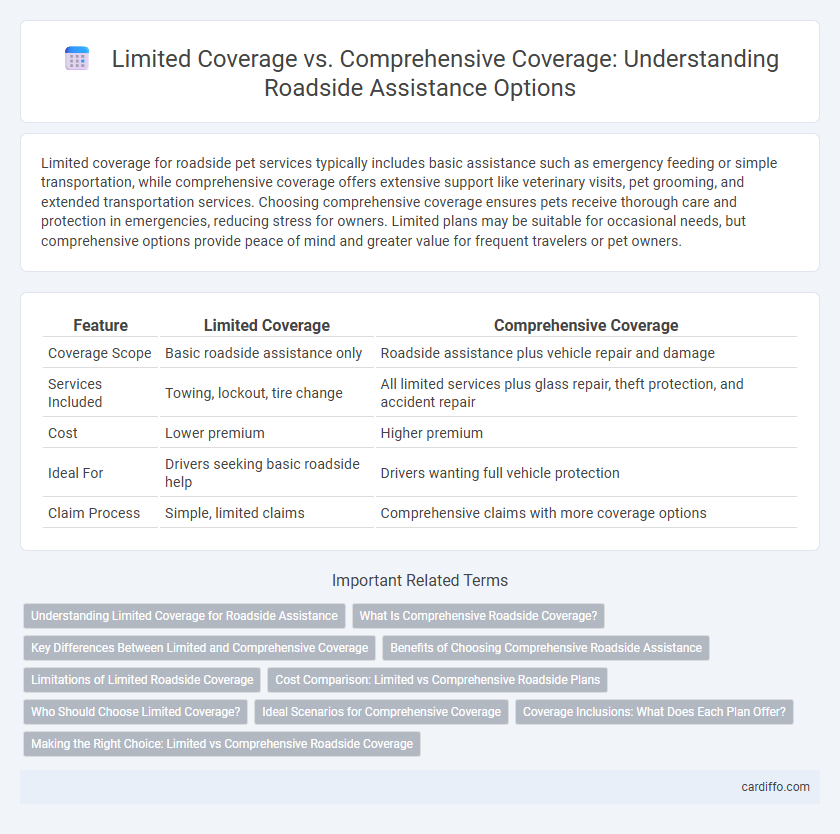

Table of Comparison

| Feature | Limited Coverage | Comprehensive Coverage |

|---|---|---|

| Coverage Scope | Basic roadside assistance only | Roadside assistance plus vehicle repair and damage |

| Services Included | Towing, lockout, tire change | All limited services plus glass repair, theft protection, and accident repair |

| Cost | Lower premium | Higher premium |

| Ideal For | Drivers seeking basic roadside help | Drivers wanting full vehicle protection |

| Claim Process | Simple, limited claims | Comprehensive claims with more coverage options |

Understanding Limited Coverage for Roadside Assistance

Limited coverage for roadside assistance typically includes essential services such as towing, battery jump-starts, flat tire changes, and lockout assistance but excludes extensive repairs or long-distance towing. This type of coverage is designed to provide quick, on-the-spot help during common roadside emergencies, minimizing wait times and costs. Understanding the specific services and limitations of limited coverage helps drivers choose appropriate plans that meet their immediate roadside needs without paying for unnecessary extras.

What Is Comprehensive Roadside Coverage?

Comprehensive roadside coverage offers extensive protection by including services such as towing, battery jump-starts, flat tire changes, fuel delivery, and lockout assistance. Unlike limited coverage that might only cover one or two specific services, comprehensive plans ensure drivers receive help for a wider range of roadside emergencies. This type of coverage minimizes unexpected towing costs and provides greater peace of mind during travel.

Key Differences Between Limited and Comprehensive Coverage

Limited coverage for roadside assistance typically includes basic services such as towing, battery jump-starts, and flat tire changes, offering essential help during minor breakdowns. Comprehensive coverage extends beyond these basics by incorporating extensive services like fuel delivery, locksmith services, and coverage for multiple vehicle issues, ensuring broader protection. The key difference lies in the scope and breadth of services, with comprehensive coverage providing more inclusive and versatile assistance compared to the restricted offerings of limited coverage.

Benefits of Choosing Comprehensive Roadside Assistance

Comprehensive roadside assistance offers extensive benefits including 24/7 emergency towing, tire changes, battery jump-starts, and fuel delivery, ensuring drivers receive immediate help in diverse situations. This coverage minimizes out-of-pocket expenses during unexpected breakdowns and enhances peace of mind by covering a broader range of roadside issues compared to limited plans. Choosing comprehensive roadside assistance maximizes vehicle protection and driver safety by addressing multiple service needs without restrictions.

Limitations of Limited Roadside Coverage

Limited roadside coverage typically includes basic services such as towing up to a specific distance and minor mechanical assistance but excludes extensive repairs or emergency fuel delivery. This type of coverage often restricts the number of service calls per year and imposes lower reimbursement limits, leaving drivers vulnerable to high out-of-pocket expenses during breakdowns. Without comprehensive roadside coverage, vehicle owners may face delays or insufficient help in critical situations like tire changes or lockouts.

Cost Comparison: Limited vs Comprehensive Roadside Plans

Limited roadside coverage typically costs significantly less than comprehensive plans, making it a budget-friendly option for drivers seeking basic services like towing and jump-starts. Comprehensive roadside plans, while more expensive, provide broader protection including fuel delivery, lockout assistance, and tire changes, offering greater peace of mind. Consumers must evaluate whether the higher premium of comprehensive coverage justifies the expanded range of services based on their driving habits and risk exposure.

Who Should Choose Limited Coverage?

Limited coverage is ideal for drivers with older vehicles or low market value cars who want to save on insurance premiums while still having basic protection. It suits individuals who primarily drive in low-risk areas or have alternative financial resources to cover potential damages. Choosing limited coverage helps minimize costs but leaves gaps in protection against comprehensive risks like theft or natural disasters.

Ideal Scenarios for Comprehensive Coverage

Comprehensive coverage is ideal for vehicles frequently exposed to various risks such as theft, vandalism, natural disasters, and animal collisions. This type of insurance is essential for owners of newer, high-value cars or those living in areas prone to extreme weather or high crime rates. Comprehensive coverage ensures extensive protection beyond standard roadside assistance, minimizing financial loss from unexpected damages.

Coverage Inclusions: What Does Each Plan Offer?

Limited coverage roadside assistance typically includes essential services such as emergency towing, flat tire changes, and jump-starts, ensuring critical help during vehicle breakdowns. Comprehensive coverage expands on these basics by adding fuel delivery, lockout services, and winching, offering more extensive support for a wider range of roadside emergencies. Choosing between plans depends on the level of protection desired, with comprehensive coverage providing broader service inclusions for enhanced peace of mind on the road.

Making the Right Choice: Limited vs Comprehensive Roadside Coverage

Choosing between limited and comprehensive roadside coverage depends on your driving habits, vehicle age, and risk tolerance. Limited coverage typically offers essential services like towing and battery jump-starts, suitable for low-mileage drivers or newer cars. Comprehensive coverage provides broader protection, including fuel delivery, lockout assistance, and tire changes, ideal for frequent drivers seeking maximum peace of mind on the road.

Limited Coverage vs Comprehensive Coverage Infographic

cardiffo.com

cardiffo.com