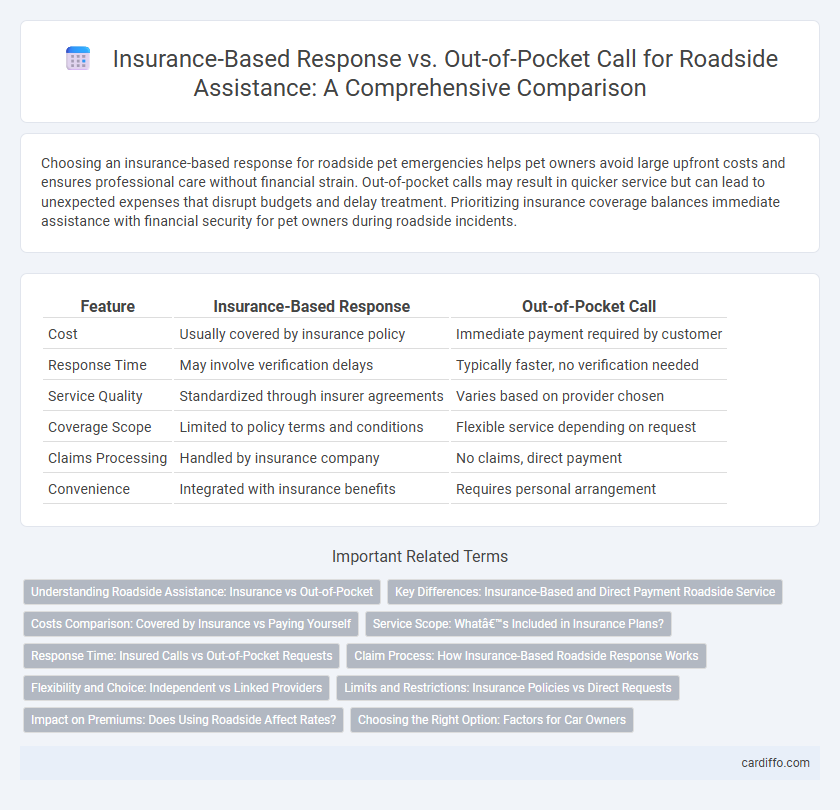

Choosing an insurance-based response for roadside pet emergencies helps pet owners avoid large upfront costs and ensures professional care without financial strain. Out-of-pocket calls may result in quicker service but can lead to unexpected expenses that disrupt budgets and delay treatment. Prioritizing insurance coverage balances immediate assistance with financial security for pet owners during roadside incidents.

Table of Comparison

| Feature | Insurance-Based Response | Out-of-Pocket Call |

|---|---|---|

| Cost | Usually covered by insurance policy | Immediate payment required by customer |

| Response Time | May involve verification delays | Typically faster, no verification needed |

| Service Quality | Standardized through insurer agreements | Varies based on provider chosen |

| Coverage Scope | Limited to policy terms and conditions | Flexible service depending on request |

| Claims Processing | Handled by insurance company | No claims, direct payment |

| Convenience | Integrated with insurance benefits | Requires personal arrangement |

Understanding Roadside Assistance: Insurance vs Out-of-Pocket

Roadside assistance provided through insurance policies often includes services such as towing, tire changes, and fuel delivery at no additional cost beyond premiums, ensuring predictable expenses. Out-of-pocket calls require upfront payment, which can vary widely depending on the service provider and specific roadside help needed. Understanding the cost-benefit dynamics between insurance-based assistance and immediate out-of-pocket expenses helps drivers choose the most efficient and economical roadside support.

Key Differences: Insurance-Based and Direct Payment Roadside Service

Insurance-based roadside service typically covers expenses through the policyholder's coverage, reducing or eliminating immediate out-of-pocket costs, while direct payment calls require customers to pay upfront for services rendered. Insurance plans often include negotiated rates with service providers, leading to cost savings, whereas out-of-pocket payments may involve higher fees due to lack of prearranged agreements. Key differences revolve around payment methods, cost predictability, and the administrative process of claims versus immediate settlement.

Costs Comparison: Covered by Insurance vs Paying Yourself

Insurance-based roadside assistance typically covers costs such as towing, tire changes, and fuel delivery, significantly reducing out-of-pocket expenses. Paying for roadside services independently can lead to higher immediate costs, sometimes ranging from $50 to $150 or more per incident. Choosing insurance coverage offers financial predictability and protection against unexpected roadside emergencies, while out-of-pocket payments provide flexibility but at potentially higher and variable costs.

Service Scope: What’s Included in Insurance Plans?

Insurance-based roadside assistance plans typically cover essential services such as towing, battery jump-start, tire change, fuel delivery, and lockout assistance within specified limits. Coverage often extends to trip interruption, emergency repairs, and sometimes concierge services, depending on the provider and plan tier. Out-of-pocket calls may offer similar services but lack the negotiated rates, broader protection, and peace of mind insurance plans provide during unexpected roadside emergencies.

Response Time: Insured Calls vs Out-of-Pocket Requests

Insurance-based roadside assistance calls typically experience faster response times due to pre-negotiated service agreements and established provider networks. In contrast, out-of-pocket requests may face delays caused by payment processing and lack of prioritization within service queues. Efficient coordination between insurers and service providers significantly reduces wait times for insured customers compared to those paying out of pocket.

Claim Process: How Insurance-Based Roadside Response Works

Insurance-based roadside response involves coordinating with your insurance provider to activate emergency services covered under your policy. Upon requesting assistance, your insurer verifies your coverage and authorizes payment directly to the service provider, streamlining the claim process and reducing upfront costs. This method ensures faster service dispatch and simplifies reimbursement by eliminating the need for out-of-pocket expenses during the incident.

Flexibility and Choice: Independent vs Linked Providers

Insurance-based roadside assistance often links customers to a network of approved service providers, limiting flexibility but ensuring coverage and standardized pricing. Out-of-pocket calls grant motorists the freedom to choose any independent provider, offering greater flexibility but potentially higher and variable costs. This trade-off highlights how consumers must balance convenience and cost predictability against personalized service options when selecting roadside assistance.

Limits and Restrictions: Insurance Policies vs Direct Requests

Insurance-based roadside assistance often imposes limits and restrictions defined by policy terms, such as coverage caps, service frequency, and approved vendors, ensuring costs are managed within the insurer's guidelines. In contrast, out-of-pocket calls provide more flexibility in service selection and timing but expose vehicle owners to potentially higher and unpredictable expenses without the protection of policy limits. Understanding these differences helps drivers weigh upfront costs against long-term financial risk when choosing roadside assistance options.

Impact on Premiums: Does Using Roadside Affect Rates?

Using roadside assistance through an insurance-based response can influence insurance premiums, as frequent claims might signal higher risk to insurers, potentially leading to rate increases. Out-of-pocket payments for roadside services typically avoid claims, helping maintain stable premiums by keeping usage off the insurer's record. Evaluating the cost-benefit of insurance claims versus direct payment is crucial for policyholders aiming to control insurance expenses while ensuring reliable roadside support.

Choosing the Right Option: Factors for Car Owners

Car owners should evaluate insurance coverage terms, including deductibles and call-out fees, when choosing between insurance-based roadside assistance and out-of-pocket calls. Assessing the frequency of roadside incidents and the reliability of service providers helps determine cost-effectiveness and convenience. Prioritizing plans with extended coverage and network partnerships maximizes benefits and minimizes unexpected expenses during emergencies.

Insurance-Based Response vs Out-of-Pocket Call Infographic

cardiffo.com

cardiffo.com