Standard coverage for rental pets typically includes essential protections such as basic accident or illness care, while supplemental coverage offers extended benefits like reimbursement for emergency services, preventive care, and wellness visits. Choosing supplemental coverage can provide broader financial protection and peace of mind by covering unexpected veterinary bills that standard plans might exclude. Assessing your pet's health needs and lifestyle helps determine the appropriate level of coverage to balance cost and comprehensive care.

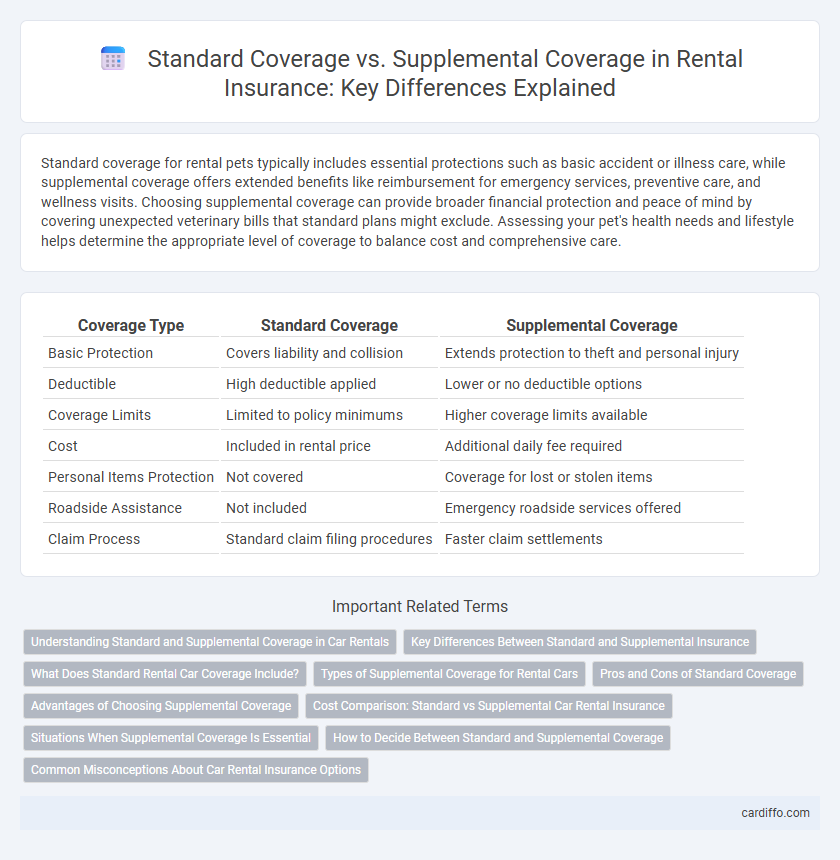

Table of Comparison

| Coverage Type | Standard Coverage | Supplemental Coverage |

|---|---|---|

| Basic Protection | Covers liability and collision | Extends protection to theft and personal injury |

| Deductible | High deductible applied | Lower or no deductible options |

| Coverage Limits | Limited to policy minimums | Higher coverage limits available |

| Cost | Included in rental price | Additional daily fee required |

| Personal Items Protection | Not covered | Coverage for lost or stolen items |

| Roadside Assistance | Not included | Emergency roadside services offered |

| Claim Process | Standard claim filing procedures | Faster claim settlements |

Understanding Standard and Supplemental Coverage in Car Rentals

Standard coverage in car rentals typically includes liability protection and basic damage waivers included in the rental price, offering essential financial protection against accidents and property damage. Supplemental coverage, such as collision damage waivers, personal accident insurance, and roadside assistance, provides enhanced protection and reduces out-of-pocket expenses in case of vehicle damage, theft, or personal injury. Understanding the differences between standard and supplemental coverage helps renters make informed decisions tailored to their risk tolerance and travel needs.

Key Differences Between Standard and Supplemental Insurance

Standard rental insurance coverage typically includes basic protection such as liability, collision, and comprehensive coverage, ensuring financial responsibility for common damages or accidents. Supplemental insurance provides additional protection options like roadside assistance, personal effects coverage, or gap insurance, addressing risks that standard policies often exclude. The key difference lies in the extent of coverage and customizable options, with supplemental plans offering enhanced security tailored to specific rental needs.

What Does Standard Rental Car Coverage Include?

Standard rental car coverage typically includes liability protection, which covers bodily injury and property damage to others, as well as collision damage waiver (CDW) or loss damage waiver (LDW) that shields renters from financial responsibility in case of vehicle damage or theft. It often provides basic roadside assistance and covers the rental period specified in the agreement. However, standard coverage may exclude personal accident insurance, personal effects coverage, and protection against loss due to uninsured drivers, which are usually offered through supplemental coverage options.

Types of Supplemental Coverage for Rental Cars

Standard coverage for rental cars typically includes basic liability protection and limited collision damage waivers, which cover primary damages from accidents or theft. Supplemental coverage options expand protection with types such as Personal Accident Insurance (PAI) for medical expenses, Theft Protection to cover stolen vehicles beyond standard limits, and Roadside Assistance for emergency services like towing and flat tire support. Other common supplemental options include Loss Damage Waiver (LDW), which covers vehicle repair costs without deductibles, and Personal Effects Coverage to safeguard belongings inside the rental car.

Pros and Cons of Standard Coverage

Standard coverage in rental agreements typically includes basic protection such as collision damage waiver, theft protection, and third-party liability up to a certain limit, ensuring essential financial safety during the rental period. The primary benefit is its cost-effectiveness and simplicity, offering adequate coverage without substantial extra fees, but it often comes with limitations like high deductibles, exclusions on certain damages, and insufficient coverage for personal belongings. Relying solely on standard coverage may expose renters to unexpected out-of-pocket expenses from accidents or damages not fully covered, prompting some to consider supplemental coverage for more comprehensive protection.

Advantages of Choosing Supplemental Coverage

Supplemental coverage offers enhanced protection by covering costs not included in standard rental insurance, such as roadside assistance and loss of use fees. This additional coverage reduces out-of-pocket expenses and provides peace of mind during unforeseen events or accidents. Choosing supplemental coverage ensures comprehensive financial security, safeguarding renters from unexpected liabilities.

Cost Comparison: Standard vs Supplemental Car Rental Insurance

Standard car rental insurance typically covers basic liabilities and collision damage protection included in the rental price, resulting in lower upfront costs. Supplemental coverage offers enhanced protections such as theft, personal injury, and roadside assistance but increases the overall rental expense significantly. Comparing costs reveals that while standard coverage is cost-efficient for low-risk renters, supplemental insurance is a valuable investment for travelers seeking comprehensive financial protection.

Situations When Supplemental Coverage Is Essential

Standard coverage typically includes liability and basic damage protection but often excludes items like personal belongings, roadside assistance, or high-value items. Supplemental coverage becomes essential in situations involving extended travel, off-road driving, or when renting luxury or specialty vehicles that require higher protection limits. It also provides crucial financial security against theft, uninsured drivers, and specific damages not covered under standard policies.

How to Decide Between Standard and Supplemental Coverage

Evaluating rental insurance options requires analyzing the scope of protection each offers, with standard coverage typically including basic liability and property damage, while supplemental coverage extends to gaps like personal belongings and roadside assistance. Assess factors such as the rental duration, value of insured items, and potential risks in the rental environment to determine if supplemental coverage justifies its additional cost. Comparing specific policy details, deductibles, and exclusions ensures a balanced decision aligned with individual needs and financial security.

Common Misconceptions About Car Rental Insurance Options

Many renters mistakenly believe that standard coverage fully protects them against all damages and liabilities during a car rental period, but it often excludes certain risks like theft or personal injury. Supplemental coverage, such as Collision Damage Waiver (CDW) or Personal Accident Insurance (PAI), fills these gaps by offering broader protection tailored to specific incidents. Understanding the distinctions between standard and supplemental options prevents unexpected expenses and ensures comprehensive coverage while renting a vehicle.

Standard coverage vs Supplemental coverage Infographic

cardiffo.com

cardiffo.com