Company car registration often involves different tax benefits and insurance requirements compared to personal car registration, reflecting its use for business purposes. Personal car registration typically requires less documentation and is based on individual ownership without the complexities of corporate liability. Understanding the distinctions ensures compliance with legal regulations and maximizes financial advantages for vehicle owners.

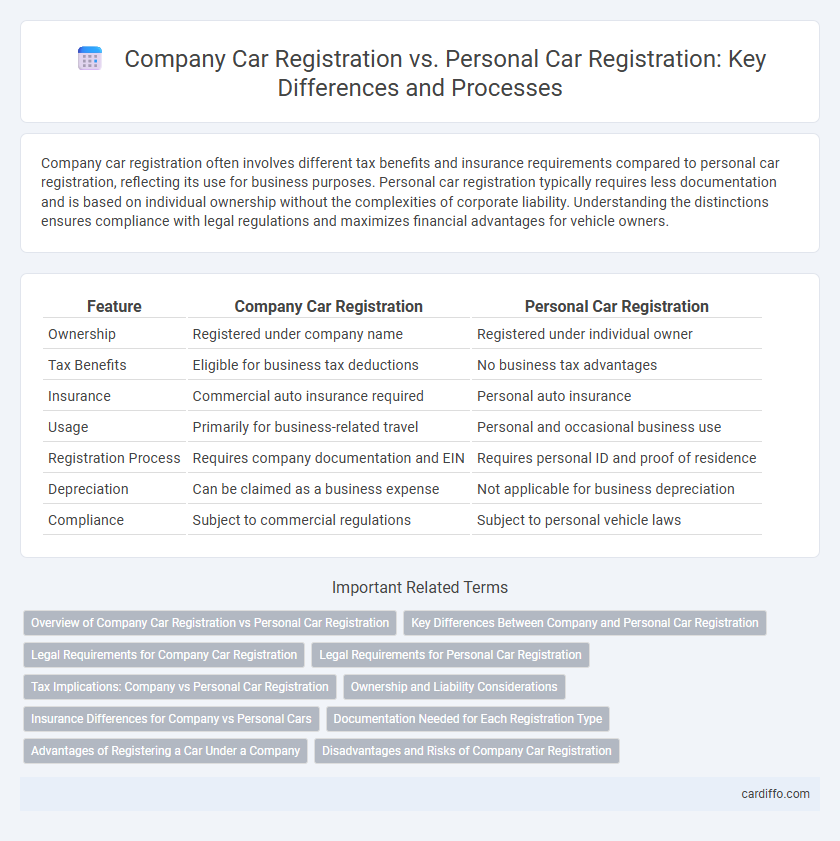

Table of Comparison

| Feature | Company Car Registration | Personal Car Registration |

|---|---|---|

| Ownership | Registered under company name | Registered under individual owner |

| Tax Benefits | Eligible for business tax deductions | No business tax advantages |

| Insurance | Commercial auto insurance required | Personal auto insurance |

| Usage | Primarily for business-related travel | Personal and occasional business use |

| Registration Process | Requires company documentation and EIN | Requires personal ID and proof of residence |

| Depreciation | Can be claimed as a business expense | Not applicable for business depreciation |

| Compliance | Subject to commercial regulations | Subject to personal vehicle laws |

Overview of Company Car Registration vs Personal Car Registration

Company car registration involves registering a vehicle under a business name, often benefiting from tax deductions and business-related insurance policies, while personal car registration is tied to an individual's name with personal liability and standard insurance coverage. Company cars typically require documentation such as a business license and proof of company ownership, contrasting with personal registrations that mandate individual identification and residential address. Understanding the distinctions in tax implications, legal responsibilities, and insurance requirements is essential for compliant and efficient vehicle registration management.

Key Differences Between Company and Personal Car Registration

Company car registration typically involves vehicles owned or leased by a business, with tax benefits, expense deductions, and specific insurance requirements tailored for commercial use. Personal car registration is linked to individual ownership, emphasizing personal liability, standard insurance policies, and registration fees based on private use. Key differences include ownership structure, tax treatment, insurance coverage, and eligibility for business-related deductions or perks.

Legal Requirements for Company Car Registration

Company car registration requires adherence to specific legal requirements, including vehicle ownership documentation under the company name, commercial insurance policies, and compliance with tax regulations such as VAT and employee benefit reporting. Registration must reflect the company as the registered keeper to ensure liability and tax responsibilities are correctly assigned. Failure to meet these legal criteria can result in penalties and increased scrutiny from transport and tax authorities.

Legal Requirements for Personal Car Registration

Legal requirements for personal car registration typically include proof of ownership, valid identification, and a completed application form submitted to the relevant motor vehicle department. Personal vehicles must also pass safety and emissions inspections depending on state laws, and payment of registration fees is mandatory to legally operate the vehicle. Insurance proof, often mandatory for personal car registration, ensures compliance with state liability coverage regulations.

Tax Implications: Company vs Personal Car Registration

Registering a company car often results in different tax implications compared to personal car registration, including potential claims for business expense deductions and VAT recovery on purchase and running costs. Personal car registration typically limits tax relief to mileage allowances, with fewer opportunities to offset costs against taxable income. Understanding the distinctions in tax treatment can optimize financial benefits and ensure compliance with HMRC regulations.

Ownership and Liability Considerations

Company car registration assigns ownership to the business entity, making the company responsible for insurance, taxes, and liabilities arising from vehicle use. Personal car registration designates the individual as the owner, with all legal and financial responsibilities personally assumed. Understanding these distinctions is crucial for accurate liability management and compliance with regulatory requirements.

Insurance Differences for Company vs Personal Cars

Company car registration typically requires commercial vehicle insurance, which offers broader coverage including liability for business-related incidents, higher liability limits, and protection for multiple drivers. Personal car registration generally mandates personal auto insurance, which is designed for everyday use with lower premiums but limited coverage focused on individual liability and personal use cases. Insurance premiums for company cars are often higher due to increased risk exposure and usage frequency compared to personal vehicles.

Documentation Needed for Each Registration Type

Company car registration requires documentation such as the company's business license, proof of ownership, and a corporate resolution authorizing the vehicle's registration under the company name. Personal car registration typically involves providing the owner's government-issued ID, proof of insurance, and the vehicle title or bill of sale. Both registrations demand a completed application form and payment of registration fees, but company registrations often necessitate additional paperwork to verify business status.

Advantages of Registering a Car Under a Company

Registering a car under a company offers significant tax benefits, including deductions on depreciation, maintenance, and fuel expenses, which can reduce overall taxable income. It provides liability protection by separating personal assets from business liabilities, safeguarding owners from potential legal claims. Additionally, company car registration enhances brand image and can streamline bookkeeping by consolidating vehicle-related expenses within the business accounts.

Disadvantages and Risks of Company Car Registration

Company car registration often results in higher tax liabilities and increased administrative responsibilities compared to personal car registration. Insurance premiums tend to be more expensive due to commercial use classification, increasing overall ownership costs. Risks include potential complications with liability coverage and stricter compliance requirements that can lead to fines or penalties if not properly managed.

Company Car Registration vs Personal Car Registration Infographic

cardiffo.com

cardiffo.com