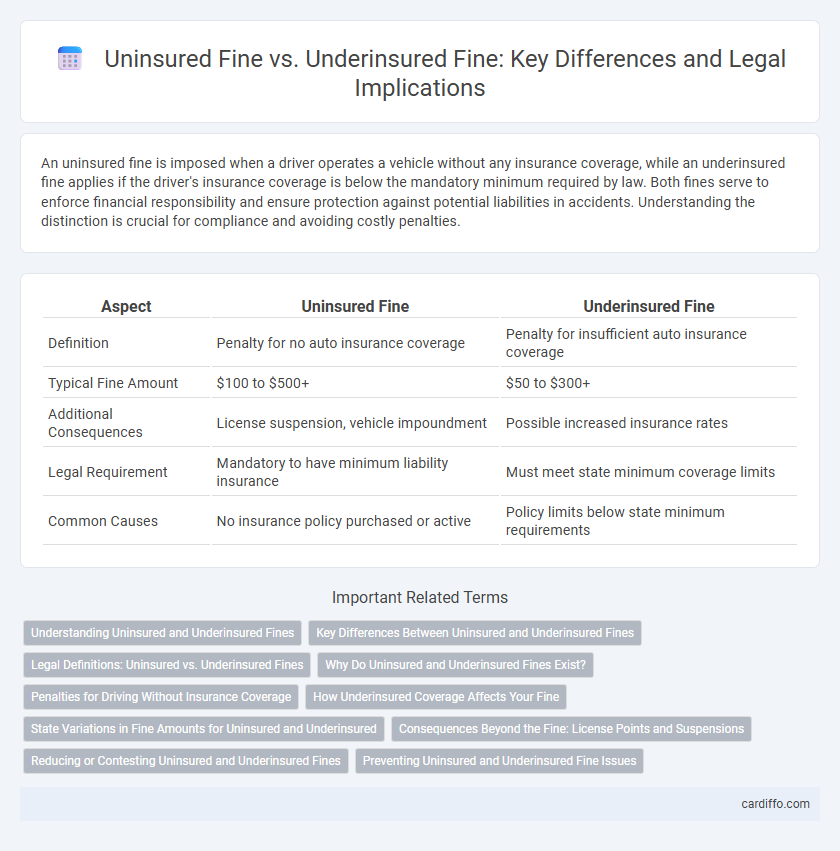

An uninsured fine is imposed when a driver operates a vehicle without any insurance coverage, while an underinsured fine applies if the driver's insurance coverage is below the mandatory minimum required by law. Both fines serve to enforce financial responsibility and ensure protection against potential liabilities in accidents. Understanding the distinction is crucial for compliance and avoiding costly penalties.

Table of Comparison

| Aspect | Uninsured Fine | Underinsured Fine |

|---|---|---|

| Definition | Penalty for no auto insurance coverage | Penalty for insufficient auto insurance coverage |

| Typical Fine Amount | $100 to $500+ | $50 to $300+ |

| Additional Consequences | License suspension, vehicle impoundment | Possible increased insurance rates |

| Legal Requirement | Mandatory to have minimum liability insurance | Must meet state minimum coverage limits |

| Common Causes | No insurance policy purchased or active | Policy limits below state minimum requirements |

Understanding Uninsured and Underinsured Fines

Uninsured fines are penalties imposed on drivers caught operating a vehicle without any insurance coverage, reflecting the legal requirement to maintain minimum liability insurance. Underinsured fines occur when a driver's insurance coverage is below the mandated minimum limits, resulting in insufficient protection in the event of an accident. Understanding uninsured and underinsured fines is crucial for avoiding costly legal consequences and ensuring compliance with state insurance laws.

Key Differences Between Uninsured and Underinsured Fines

Uninsured fines apply when a driver operates a vehicle without any valid insurance coverage, resulting in penalties that vary by state but often include hefty monetary fines and license suspension. Underinsured fines occur when a driver's insurance coverage exists but fails to meet the minimum required liability limits, leading to penalties that may involve fines, increased insurance premiums, or mandatory financial responsibility proof. The key difference lies in the presence of insurance coverage, where uninsured fines penalize total lack of coverage, and underinsured fines address insufficient coverage against state-mandated minimums.

Legal Definitions: Uninsured vs. Underinsured Fines

Uninsured fines are penalties imposed when a driver operates a vehicle without any insurance coverage, violating state laws that mandate minimum insurance requirements. Underinsured fines apply when a driver carries insurance that does not meet the legally required minimum coverage limits, failing to fully protect against liabilities in accidents. Legal definitions distinguish these fines based on the presence and adequacy of insurance coverage, with uninsured fines addressing total lack of insurance and underinsured fines targeting insufficient policy limits.

Why Do Uninsured and Underinsured Fines Exist?

Uninsured and underinsured fines exist to enforce compliance with minimum insurance requirements, ensuring that drivers carry adequate coverage for potential damages or injuries. These fines act as deterrents against driving without proper insurance, reducing financial risk and protecting victims in accidents. By imposing penalties, states promote public safety and financial responsibility on the road.

Penalties for Driving Without Insurance Coverage

Penalties for driving without insurance coverage vary significantly between uninsured and underinsured fines, often including steep monetary fines, license suspension, and potential vehicle impoundment. Uninsured fines typically carry harsher consequences as they involve complete absence of insurance, leading to higher financial penalties and longer suspension periods compared to underinsured fines. Underinsured drivers face fines for not meeting minimum liability limits, which can result in moderate fines and restricted driving privileges, emphasizing the importance of adequate coverage to avoid severe legal repercussions.

How Underinsured Coverage Affects Your Fine

Underinsured coverage can significantly reduce the fine imposed for insufficient insurance by bridging the gap between your policy limits and actual damages. This type of coverage decreases your financial liability, minimizing the risk of expensive penalties related to underinsured claims. Having adequate underinsured coverage ensures compliance with state laws, potentially lowering or eliminating fines associated with coverage shortfalls.

State Variations in Fine Amounts for Uninsured and Underinsured

State variations in uninsured and underinsured motorist fines reflect differing legal thresholds and penalty structures across the U.S., with uninsured vehicle fines ranging typically from $100 to over $1,000 depending on state legislation. Underinsured motorist fines often vary less but can include additional financial penalties or requirement of higher minimum coverage amounts, influencing the total fine calculation. States such as California enforce higher fines for uninsured drivers compared to others like Texas, emphasizing regulatory diversity aimed at improving road safety and insurance compliance.

Consequences Beyond the Fine: License Points and Suspensions

Uninsured and underinsured fines often carry severe consequences beyond the monetary penalty, including license points that increase insurance premiums and contribute to potential suspensions. Accumulating points from these violations can lead to suspension periods ranging from weeks to months, impacting driving privileges and employment opportunities. Persistent offenses may trigger mandatory insurance verification and court appearances, intensifying legal and financial burdens.

Reducing or Contesting Uninsured and Underinsured Fines

Reducing or contesting uninsured and underinsured fines often involves providing proof of valid insurance coverage or demonstrating errors in the issuance of the fine. Presenting documentation such as insurance declarations, payment records, or affidavits can significantly increase the chances of fine reduction or dismissal. Legal representation or filing an appeal with the relevant authorities can also be effective strategies to challenge these fines and mitigate financial penalties.

Preventing Uninsured and Underinsured Fine Issues

Preventing uninsured and underinsured fine issues requires understanding the minimum insurance coverage mandated by state laws and maintaining policies that meet or exceed these requirements. Regularly reviewing and updating insurance coverage helps avoid penalties associated with insufficient or absent automobile insurance. Utilizing digital reminders for policy renewals and verifying coverage status can effectively reduce the risk of facing fines due to lapses in insurance protection.

Uninsured Fine vs Underinsured Fine Infographic

cardiffo.com

cardiffo.com