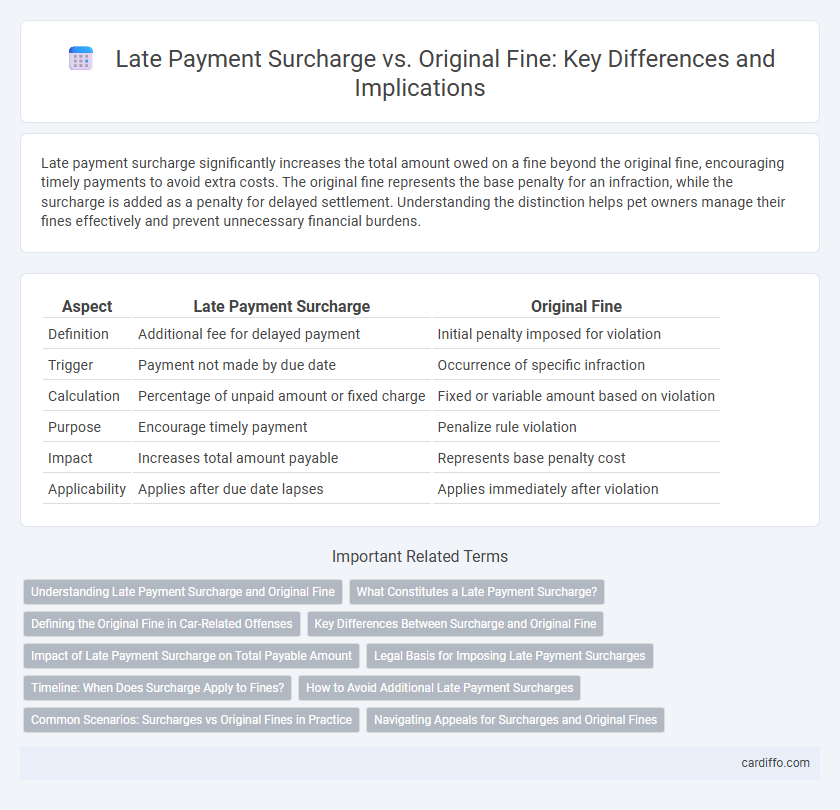

Late payment surcharge significantly increases the total amount owed on a fine beyond the original fine, encouraging timely payments to avoid extra costs. The original fine represents the base penalty for an infraction, while the surcharge is added as a penalty for delayed settlement. Understanding the distinction helps pet owners manage their fines effectively and prevent unnecessary financial burdens.

Table of Comparison

| Aspect | Late Payment Surcharge | Original Fine |

|---|---|---|

| Definition | Additional fee for delayed payment | Initial penalty imposed for violation |

| Trigger | Payment not made by due date | Occurrence of specific infraction |

| Calculation | Percentage of unpaid amount or fixed charge | Fixed or variable amount based on violation |

| Purpose | Encourage timely payment | Penalize rule violation |

| Impact | Increases total amount payable | Represents base penalty cost |

| Applicability | Applies after due date lapses | Applies immediately after violation |

Understanding Late Payment Surcharge and Original Fine

Late payment surcharge is an additional fee imposed when a payment is not made by the specified deadline, calculated as a percentage of the original fine or a fixed amount based on the jurisdiction's regulations. The original fine represents the base penalty for the infraction or violation without any added fees for delayed payments. Understanding the distinction helps taxpayers manage their liabilities by addressing the timely payment requirements to avoid extra financial burdens.

What Constitutes a Late Payment Surcharge?

A late payment surcharge is an extra fee imposed on an overdue payment, calculated as a fixed percentage or a flat amount added to the original invoice. It is designed to incentivize timely payments and compensate for the delay-related financial impact on the creditor. Unlike the original fine, which is a penalty for the initial violation or non-compliance, the late payment surcharge specifically addresses the extended timeline in settling the owed amount.

Defining the Original Fine in Car-Related Offenses

The original fine in car-related offenses refers to the base monetary penalty imposed for a specific traffic violation, such as speeding or illegal parking, as stipulated by local traffic laws. This fine is established based on the severity and category of the offense, serving as the initial amount payable by the offender. Unlike the late payment surcharge, which accumulates as a penalty for delayed remittance, the original fine represents the fundamental charge before any additional fees are applied.

Key Differences Between Surcharge and Original Fine

Late payment surcharge is an additional fee imposed when a payment is delayed beyond the due date, whereas the original fine is the initial penalty for a specific violation or infraction. The surcharge increases with the length of the delay and serves as a deterrent for late payments, while the original fine remains fixed based on the offense. Understanding this distinction helps in managing financial obligations effectively and avoiding escalating costs.

Impact of Late Payment Surcharge on Total Payable Amount

Late Payment Surcharge increases the Total Payable Amount by adding a penalty fee calculated as a percentage of the Original Fine, which accumulates over time. This surcharge can significantly escalate the financial burden, especially if payments remain overdue for extended periods, resulting in higher overall costs. Understanding the impact of Late Payment Surcharge is crucial for timely payments to avoid excessive penalties and minimize the total amount owed.

Legal Basis for Imposing Late Payment Surcharges

The legal basis for imposing late payment surcharges is established through statutes or contractual agreements that specify penalties for overdue payments to ensure timely compliance. These surcharges act as a financial incentive for debtors to avoid delays and cover administrative costs incurred by creditors. Unlike the original fine, which is a fixed penalty for specific violations, late payment surcharges specifically address the consequences of non-payment within the designated timeframe, reinforcing enforcement mechanisms under legal frameworks.

Timeline: When Does Surcharge Apply to Fines?

A late payment surcharge typically applies after the original fine payment deadline has passed, marking a specific timeline for enforcement. This surcharge is calculated as a percentage of the unpaid fine and accrues daily, weekly, or monthly depending on jurisdictional regulations. Understanding the exact due date and the subsequent grace period is crucial for avoiding additional financial penalties beyond the original fine amount.

How to Avoid Additional Late Payment Surcharges

Pay fines promptly to avoid accumulating additional late payment surcharges, which typically increase exponentially after the original fine deadline passes. Set up automated payment reminders or use digital payment methods that offer instant processing, ensuring timely settlements and preventing penalties. Regularly monitor your payment deadlines through account alerts or official notifications to maintain compliance and minimize financial liabilities.

Common Scenarios: Surcharges vs Original Fines in Practice

Late payment surcharges typically arise when an original fine remains unpaid beyond the deadline, resulting in additional fees calculated as a percentage of the initial penalty. Common scenarios include traffic violations, utility bills, and tax payments where the original fine is fixed, but surcharges increase with time and non-compliance. Understanding the escalation mechanism helps individuals manage obligations by prioritizing original fines to minimize cumulative costs caused by surcharges.

Navigating Appeals for Surcharges and Original Fines

Navigating appeals for late payment surcharges and original fines requires understanding the specific regulations governing each penalty type. Original fines typically involve fixed amounts set by enforcement bodies, while surcharges increase proportionally with the delay in payment, often complicating the appeal process. Effective appeals demand presenting clear evidence of timely payment or valid reasons for delay, emphasizing compliance with procedural deadlines to minimize additional financial liabilities.

Late Payment Surcharge vs Original Fine Infographic

cardiffo.com

cardiffo.com