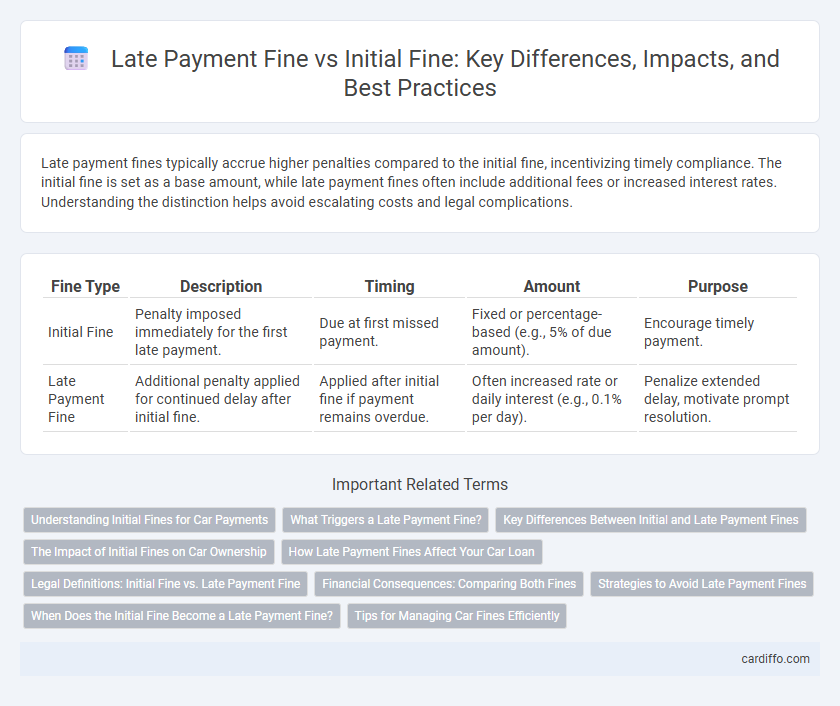

Late payment fines typically accrue higher penalties compared to the initial fine, incentivizing timely compliance. The initial fine is set as a base amount, while late payment fines often include additional fees or increased interest rates. Understanding the distinction helps avoid escalating costs and legal complications.

Table of Comparison

| Fine Type | Description | Timing | Amount | Purpose |

|---|---|---|---|---|

| Initial Fine | Penalty imposed immediately for the first late payment. | Due at first missed payment. | Fixed or percentage-based (e.g., 5% of due amount). | Encourage timely payment. |

| Late Payment Fine | Additional penalty applied for continued delay after initial fine. | Applied after initial fine if payment remains overdue. | Often increased rate or daily interest (e.g., 0.1% per day). | Penalize extended delay, motivate prompt resolution. |

Understanding Initial Fines for Car Payments

Initial fines for car payments are typically a fixed percentage of the missed installment, set to encourage timely payments and cover administrative costs. Late payment fines accumulate only after the initial fine remains unpaid beyond the due date, often increasing the total penalty significantly. Understanding the difference helps car owners manage their finances and avoid escalating costs associated with delayed payments.

What Triggers a Late Payment Fine?

Late payment fines are triggered when a payment is not received by the specified due date, as outlined in the payment agreement or invoice terms. The initial fine usually applies immediately after missing the payment deadline, while late payment fines accumulate or increase over time to incentivize prompt resolution. Specific triggers include surpassing the grace period, failing to communicate payment delays, or neglecting installment schedules.

Key Differences Between Initial and Late Payment Fines

Initial fines are typically fixed amounts imposed immediately after a payment deadline is missed, serving as a prompt penalty to encourage timely compliance. Late payment fines escalate over time, often increasing based on the duration of the delay or as a percentage of the outstanding balance, reflecting the extended non-compliance. Key differences lie in their timing, calculation method, and impact, with initial fines acting as immediate deterrents and late payment fines imposing heavier financial consequences for prolonged delays.

The Impact of Initial Fines on Car Ownership

Initial fines significantly influence car ownership by deterring late payments and promoting timely compliance with vehicle-related regulations. These early penalties reduce the likelihood of accumulating larger late payment fines, which can escalate the financial burden on car owners. Timely settlement of initial fines helps maintain clean driving records and prevents legal complications that may arise from unpaid dues.

How Late Payment Fines Affect Your Car Loan

Late payment fines on car loans significantly increase the total repayment amount, leading to higher financial strain compared to initial fines. These fines can also negatively impact your credit score, making future borrowing more difficult and costly. Consistently paying on time helps avoid late payment fines, preserving credit health and reducing overall loan costs.

Legal Definitions: Initial Fine vs. Late Payment Fine

Initial fines are penalties imposed immediately upon the occurrence of a legal or regulatory violation, defined by specific statutes or contractual agreements. Late payment fines are additional charges accrued after the initial fine remains unpaid past a designated deadline, often calculated as a percentage of the original amount or as a fixed fee. Legal definitions differentiate these fines by their timing and purpose: initial fines serve as immediate deterrents, while late payment fines incentivize prompt settlement and cover administrative costs.

Financial Consequences: Comparing Both Fines

Late payment fines often exceed initial fines in amount, significantly increasing the total financial burden on the debtor. Initial fines serve as an immediate penalty, whereas late payment fines accumulate over time, amplifying financial consequences. Comparing both fines reveals that timely payment minimizes expenses and avoids escalating monetary penalties.

Strategies to Avoid Late Payment Fines

Implementing automated payment reminders and scheduling payments before the due date effectively prevents late payment fines, which often exceed initial fines by up to 50%. Utilizing early payment discounts and maintaining a detailed payment calendar reduces financial penalties and preserves credit standing. Establishing clear communication with creditors ensures flexibility in payment terms, minimizing the risk of incurring costly late fees.

When Does the Initial Fine Become a Late Payment Fine?

The initial fine becomes a late payment fine once the payment due date passes without full settlement of the amount owed. This transition typically occurs after a specified grace period set by the creditor or governing regulations. Late payment fines often carry higher penalties or increased interest rates compared to the initial fine, reflecting the added risk and administrative costs.

Tips for Managing Car Fines Efficiently

Managing car fines efficiently requires understanding the difference between initial fines and late payment fines, with late fines often being significantly higher due to added penalties and interest. Prompt payment of initial fines helps avoid escalated costs and legal complications, while setting reminders or using online payment portals can streamline the process and reduce the risk of forgetting deadlines. Regularly reviewing traffic violations and disputing unjust fines can also save money and prevent unnecessary financial burden.

Late payment fine vs initial fine Infographic

cardiffo.com

cardiffo.com